Targeted Analysis: Who Are Really My Competitors on Amazon?

This question may sound trivial for most brands and manufacturers because one knows one’s competitors very well since they serve the same market and the same target groups. Sometimes you even know the responsible employees and contact persons of your competitors personally and by name due to a shared history and industry events. With this “recognition pattern” in mind, you may also scan Amazon for its competitors and their activities to derive your actions and plans. This is not wrong in principle and is a necessary task. The Puma brand needs to know what the Adidas brand is doing on Amazon, and the manufacturer Stanley Black and Decker are analyzing the activities of Bosch, Makita and Einhell. Which products are sold? What is the pricing policy? Do “the others” have an Amazon brand store? Are the articles equipped with A+ content? How well are the products optimized in terms of SEO and general “retail readiness”? Is the competitor vendor or seller? These are precisely the right questions, but they must not be directed exclusively at the already well-known brand competitors, who are known from the retail business, for example.

Consider Brand Search vs Generic Search on Amazon

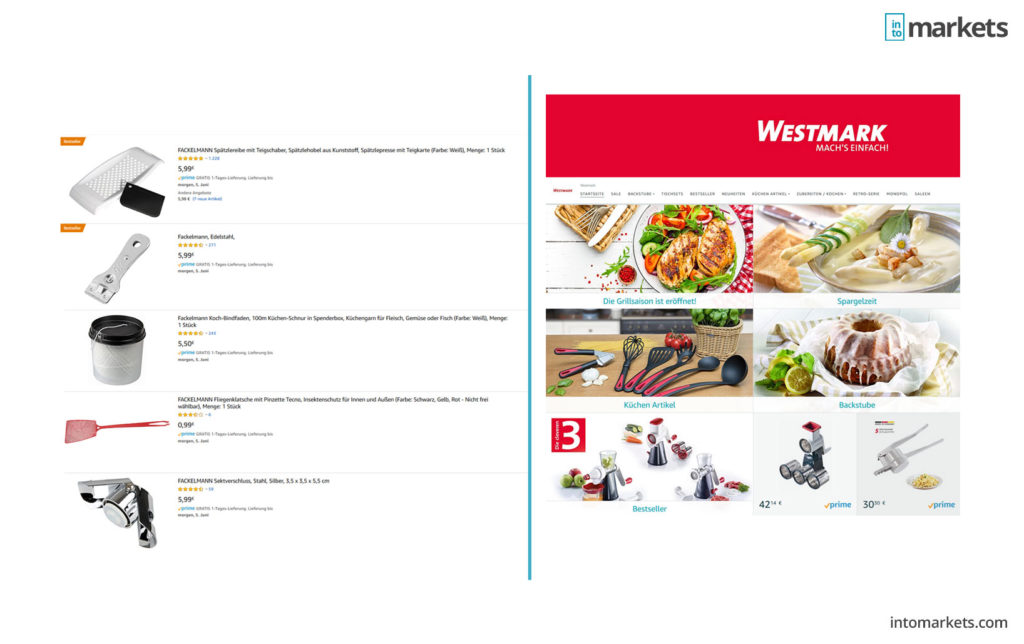

In fact, brands and manufacturers urgently need to broaden their perspective and, depending on the product category in question; they should focus on significantly more potential competitors. A crucial aspect here is the field of “generic searches”, i.e. search terms and phrases that are conducted without any brand orientation. Amazon users do not always automatically search for a combination of brands and products but are often very generically oriented. In some product categories, such types of search queries are even much more reliable than product searches directly related to a brand. In concrete terms, this can look like this:

- Grill Tongs Stainless Steel” comes ofter than “Grill Tongs Weber.”

- “Grill Tongs Wood” comes ofter than “Rösle Grill Tongs”

The conclusion here is that, although a search in this category is generally conducted with a brand reference, the generic search approach is more reliable and therefore more decisive. This means that in the second step of the Amazon competitor analysis, one should take a closer look at ALL brands and products that rank particularly high in the “Generic Searches”, as this is where a lot of traffic and very probably also sales are generated.

Amazon Competitor Analysis

So if you have identified other relatively unknown brands and manufacturers as potential competitors in addition to the well-known “neighbours”, you should take a closer look at their product portfolio, advertising activity, and general visibility on Amazon. Tools such as “Amalyze”, “Sellics” or “Helium10” provide a targeted and highly analytical insight into a brand portfolio and facilitate a time-saving and technically sober evaluation of such analysis. With such an Amazon competitor analysis, it is of course also important what you want to know in the end or what you have to make clear from the beginning as to which strategy to use. However, the following aspects are almost generally important when analyzing competitors on Amazon:

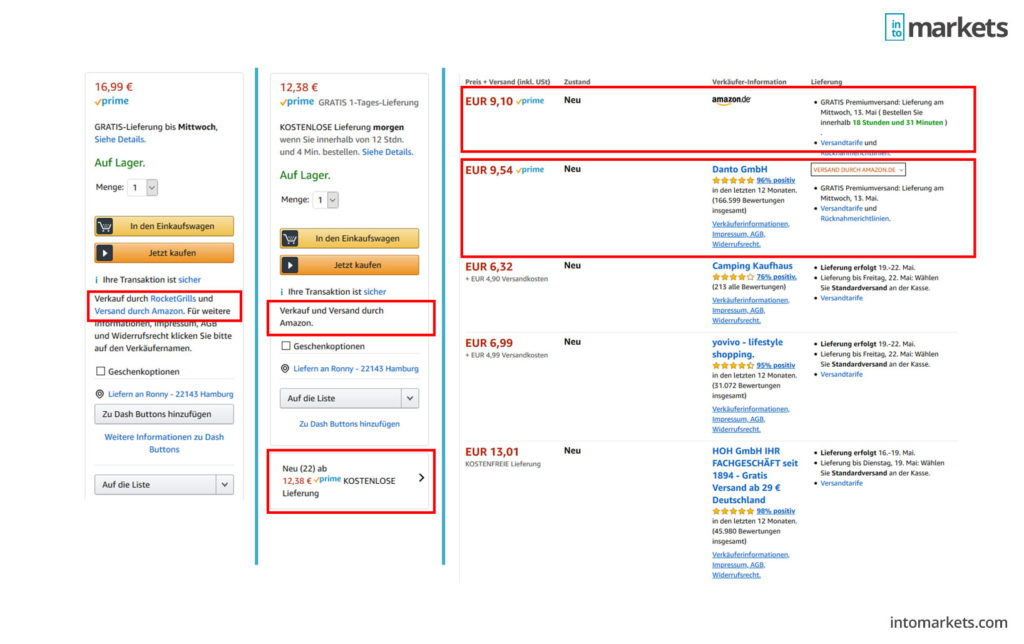

- Does the brand operate as a vendor or seller on Amazon?

- Who dominates the BuyBox and how many 3rd party sellers are there?

- How many products does the competitor sell?

- Does the competitor run performance marketing campaigns (PPC)?

- Does the competitor Amazon run retargeting campaigns (DSP)?

- How visible are my competitor’s products on Amazon?

- In which product categories does the other brand sell?

- Does my competitor have a prime status for his products, or does he use FBA or FBM as a seller?

- How many ratings do the competitor products have and at what average rating?

- How well are the products optimized for Amazon keywords?

- Is A+ content available, and how well is it structured?

- Is a brand store available and how professional and up-to-date is it designed?

Starting from each question, you can, of course, dive much deeper into the technical details and also broaden the competitor analysis on Amazon even further. These are only the most frequent questions that we, for example, as an Amazon agency, are often confronted with when it comes to such an analysis.

Perform Competitor Analysis on Amazon With Tools and Manual View

Not all these questions can be explicitly answered with analytical tools such as “Amalyze”, “Sellics” or “Helium10”. The quality of content, also in terms of sales psychology, target group appeal, and conversion probability, can often only be evaluated manually. Whether A+ content is available and whether a brand store has been built up and, above all, how well this has been done for the target group is also challenging to analyze in a tool-controlled manner. Here, above all, professional experience, as well as product know-how, is required to evaluate these factors.

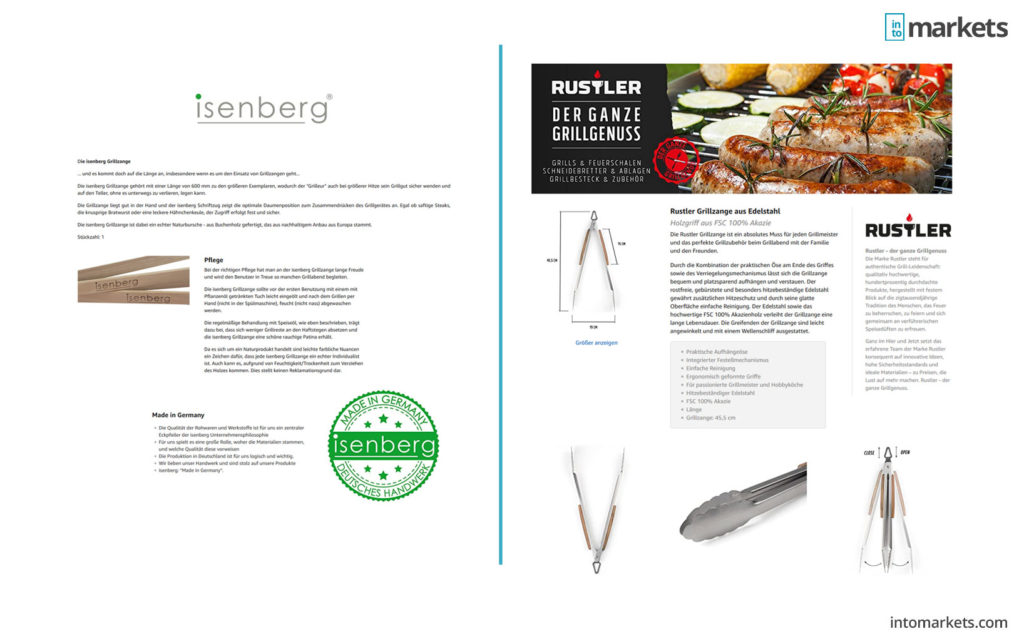

Competitor analysis: A+ Content

So if my competitor on Amazon has now added A+ content to all his products, it’s not enough to catch up somehow. You have to take a closer look at this point, how good the quality is and what you can maybe do better yourself. If my competitor’s A+ content is already at an outstanding, professional level, you should aim for at least a similar level here. At this point, adding something as A+ content to check this point off on your checklist is certainly not the way to go. On the other hand, the same applies if you find out that your competitor previously did not provide any A+ content, but now provides much higher quality content than you do. Standstill can cost important conversions and thus also sales in the medium and long term.

Competitor analysis: Brandstore

Manual competitor analysis is also necessary regarding the brand stores on Amazon. Honestly, sales will tend not to explode just because one has implemented a general or better brand store than the competitor brand. However, the principle still applies that the customer journey of a potential buyer often has several touchpoints with a brand. A brand store can be one such touchpoint. If it is not available or only available in an unprofessional manner, this does not automatically result in a slump in sales. Still, it does leave an aftertaste with consumers. An Amazon brand store is also not the first thing that manufacturers have to do when it comes to their general brand presence in the marketplace. But it is an important, additional building block that can lead to a targeted differentiation or catching up with the competition.

Competitor analysis: SEO and retail readiness

At this point, an analysis of Amazon’s competitors can again be realized very well tool-controlled. For how many and which keywords and average positions a competitor with his product ranks in the SERP (search results page) can be made visible and continuously monitored with many tools. Whether and how many product reviews are available is also a measure that various Amazon tools can track. By the way, you should also continuously monitor your reviews and especially react to negative reviews. If the competitor does not do this, for example, you can also draw your own advantage from this. A further and very sales-effective factor regarding “Retail Readiness” on Amazon are product images. This is where the proverbial “wheat from the chaff” often separates. No matter how well the keywords are researched and how much work has been put into A+ Content and Brandstore. If the rudimentary product images are not on a professional and target group-oriented level, it will be equally painful for a seller or vendor. So if the competitor is better positioned in this respect, this is one of the first and decisive steps to enhance your products.

Competitor analysis: Vendor vs Seller

An often neglected aspect of the Amazon competitor analysis is the crucial question of which seller/partner program was chosen. Today, a vendor no longer has many advantages over a seller but has many more restrictions regarding the products offered, sales prices and the updating of its product data. If resellers also provide the product, i.e. 3rd party sellers (grey market) at the same time, targeted optimization measures in the area of SEO and Amazon Advertising are very difficult anyway. So if you are “trapped” as a vendor, but recognize an urgent need to catch up with your competitors on Amazon, you should urgently consider your own seller strategy or at least a vendor-seller hybrid solution. Implementing this is then also a mammoth task and requires additional know-how and manpower (external and/or internal). But you should not shy away from this if you want to be (permanently) successful on the Amazon marketplace.

Conclusion: A Competitor Analysis Is a Must for Every Manufacturer on Amazon

What has long been understood in the retail trade and is also lived practice, still needs to be significantly improved in e-commerce and on Amazon in particular: Know your competitor and react appropriately. The bigger and more diversified your portfolio is, the broader the field of competition will be. In an open marketplace like Amazon with shallow entry barriers for new sellers and unknown brands, you suddenly have to deal with entirely different players as a well-known brand and well-known manufacturer. They are in the same categories as you are. Especially on Amazon, brand loyalty is often low or even non-existent. Potential buyers are more likely to be guided to buy by factors such as price, prime status, product recessions and high product visibility. Especially in this environment, many independent sellers and small (new) brands are much more agile than well-known manufacturers. This is no small challenge, especially for large corporations, but one that can be tackled and solved with the right strategy. The first step is always to be aware of how Amazon works. The second step is to have a clear goal of what you want to achieve in the marketplace. And the resulting next step is a targeted competitor analysis on Amazon to derive the right measures and strategies.

We support brands and manufacturers on Amazon

Such an analysis and the right strategy based on it often requires much time and a good “bird’s eye view” across different categories. As an agency, we have many years of experience in the seller and vendor sector, expertise in PPC and DSP marketing, A+ content as well as brand store creation and of course all Amazon SEO basics. We already bring this experience to many medium-sized companies as well as international global brands and help brands and manufacturers to make the right decision on Amazon and to improve and expand it continuously.

Do you need some help with that? Then let’s talk about your Amazon business without obligation and see how we can help you.

Leave A Comment